Effortless payroll, timely disbursement, smart financing

Access Salary. Run Payroll. Finance Business

Payroll

Financing

Fed up with playing the waiting game when it comes to paying your employees? ABHI’s got your back! Say goodbye to those awkward “Sorry, payroll’s delayed again” conversations and hello to smooth sailing. With ABHI’s payroll financing, you call the shots on payday. No more holding your breath or watching your team eyeing other job listings.

Ever delayed employees salaries because of the cashflow constraints? Now you don’t have to, ABHI will finance your payroll and you can run it at the time of your convenience. Also keeps your employees from start looking for another job

Payroll

Financing

Fed up with playing the waiting game when it comes to paying your employees? ABHI’s got your back! Say goodbye to those awkward “Sorry, payroll’s delayed again” conversations and hello to smooth sailing. With ABHI’s payroll financing, you call the shots on payday. No more holding your breath or watching your team eyeing other job listings.

Ever delayed employees salaries because of the cashflow constraints? Now you don’t have to, ABHI will finance your payroll and you can run it at the time of your convenience. Also keeps your employees from start looking for another job

Payroll

Processing

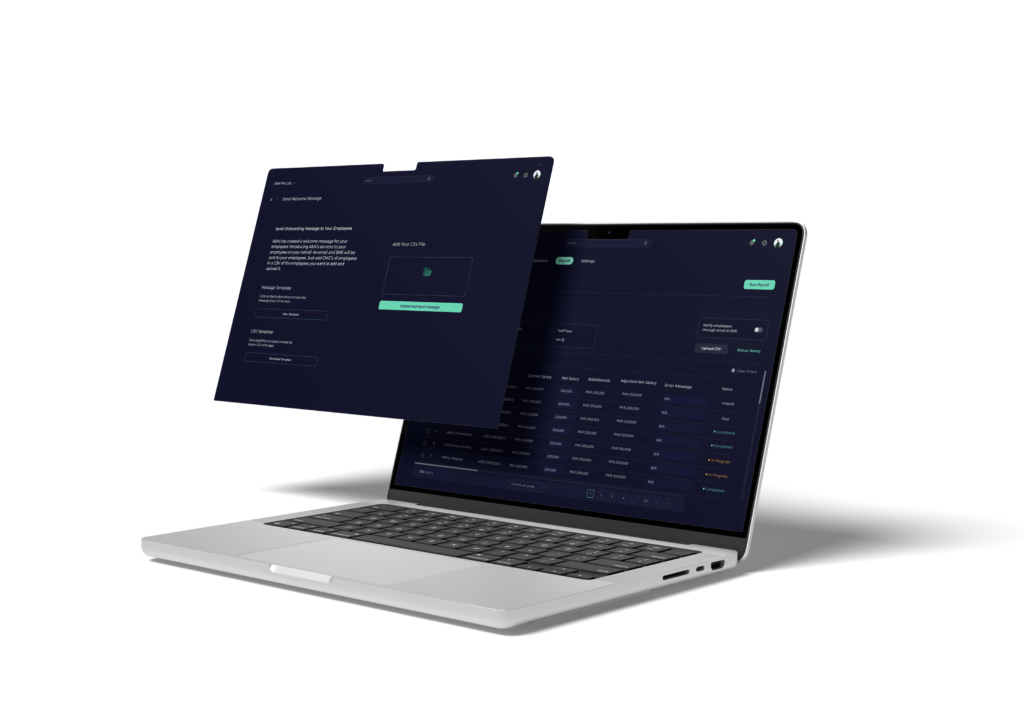

manage your payroll, even when the funds are available? Take control of your company’s payroll process with ease and convenience. Our portal allows you to instantly add or remove employees, giving you the freedom to manage payroll on your own terms. What’s more, your employees can receive their salaries directly in any bank account or wallet across Pakistan.

Take charge of hassle-free payroll! Our portal lets you add or remove employees instantly, giving you control. Your team gets salaries directly in any Pakistan bank account or wallet. Simplify your payroll process now!

Payroll

Processing

manage your payroll, even when the funds are available? Take control of your company’s payroll process with ease and convenience. Our portal allows you to instantly add or remove employees, giving you the freedom to manage payroll on your own terms. What’s more, your employees can receive their salaries directly in any bank account or wallet across Pakistan.

Take charge of hassle-free payroll! Our portal lets you add or remove employees instantly, giving you control. Your team gets salaries directly in any Pakistan bank account or wallet. Simplify your payroll process now!

AbhiPayroll

Features

- Run Payroll on Demand

- Transfer to any Bank or Wallet in Pakistan

- Dedicated Online Portal

- Greater Control over Cash flow

How it

works

Step 1

Company Information

Your company representative can reach out to our team and submit the required company documents which will be required to analyze your company health.

Step 2

Company Analysis

ABHI’s risk and compliance departments will run their analysis to determine the financial stability and credibility of the company.

Step 3

Company Onboarding

After the company is approved, the company will be provided with the access to ABHI Employer Portal, which they can use for salary disbursements whenever they want.

Step 4

Running your Payroll

The company can deposit money into the account, add or remove employees from the portal, and send the salaries in any bank or wallet in Pakistan. In case of financing, ABHI will pre-fund the account so the payroll runs smoothly, and company pays back later.

A step-by-step process of the user’s journey

for your company getting onboard to run payroll on demand.

How it

works

A step-by-step process of the user’s journey

for your company getting onboard to run payroll on demand.

Step 1

Company Information

Your company representative can reach out to our team and submit the required company documents which will be required to analyze your company health.

Step 2

Company Analysis

ABHI’s risk and compliance departments will run their analysis to determine the financial stability and credibility of the company.

Step 3

Company Onboarding

After the company is approved, the company will be provided with the access to ABHI Employer Portal, which they can use for salary disbursements whenever they want.

Step 4

Running your Payroll

The company can deposit money into the account, add or remove employees from the portal, and send the salaries in any bank or wallet in Pakistan. In case of financing, ABHI will pre-fund the account so the payroll runs smoothly, and company pays back later.

Use

Cases

When and where can this be used?

Case 1

SMEs

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 2

Retail Companies

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 3

HR Outsourcing firm

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 1

Production Companies

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 2

IT Companies

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 3

Service Sector

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Use

Cases

When and where can this be used?

Case 1

SMEs

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 2

Retail Companies

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 3

HR Outsourcing firm

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 1

Production Companies

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 2

IT Companies

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Case 3

Service Sector

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 2 :

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Use

Cases

When and where can this be used?

For many small and medium-sized enterprises (SMEs) with limited human resources, outsourcing payroll services to a third party is a common practice for monthly salary disbursements. However, this dependency on third party can sometimes result in unavoidable delays, impacting both the company and its employees.

Option 1:

The company relies on a third party for salary disbursement, resulting in delays and limited flexibility in managing payroll efficiently.

Option 2:

By utilizing ABHI’s payroll processing facility, the company gets access to a dedicated portal that streamlines payroll management. Through ABHI’s partnership with 1 Link, the company can disburse salaries into employees’ bank accounts with just one click, eliminating delays and improving overall efficiency.

Case 1

Production factory often faces the challenge of delayed payments for its goods sold, which can impact its operations. One aspect affected by these delays is the company’s ability to meet its financial obligations, particularly in disbursing employee salaries.

Option 1:

The company could choose the traditional approach, wherein it waits for payment clearance before disbursing salaries to its employees. However, this approach may result in decreased efficiency among employees.

Option 2:

The company could utilize the ABHI Payroll Financing solution to ensure timely salary disbursements to its employees. This approach ensures employee satisfaction, boosts retention rates, and maintains operational efficiency without financial constraints.

Case 2

A retailer employing contractual workers encounters difficulties in maintaining accurate and up-to-date employee data, due to frequent turnover. This instability in workforce poses challenges to efficient payroll management, leading to inefficiencies within the system.

Option 1:

The retailer continues to rely on manual methods to manage employee data and struggles to keep up with the constant flux of contractual workers. This outdated approach is time-consuming, prone to errors, and impacts the efficiency of payroll management.

Option 2:

By partnering with ABHI, the retailer gains access to automated payroll services through a dedicated portal, wherein ABHI’s system efficiently handles employee data, ensuring accurate and up-to-date payroll records. Through seamless integration and automation, ABHI streamlines payroll processes, reducing the administrative burden on the retailer and minimizing the risk of errors.

Case 2

A software house relies on international clients for revenue streams and the delays in invoice clearance directly affect its ability to pay employee salaries on time.

Option 1:

One approach for the software house is to delay employees’ salaries until it receives payments from international clients. However, this method risks dissatisfaction among employees, resulting in decreased morale and productivity.

Option 2:

Alternatively, the software house can partner with ABHI to leverage its Payroll Financing services. By doing so, the company can ensure timely disbursement of salaries to its employees, regardless of invoice clearance delays with international clients. This approach ensures employee satisfaction and maintains operational efficiency without financial constraints.

Case 3

An HR Outsourcing firm onboards employees of an X company on third-party payroll. However, these employees are dispersed across various regions of the country and maintain accounts in different banks. The HR outsourcing firm has to consolidate the accounts of X company’s employees into a single bank to run the payroll, which is causing a delay in the disbursement of salaries for all the employees.

Option 1:

The HR outsourcing firm experiences delays as it waits for employees to open accounts in designated banks. This solution requires time and effort, leading to inefficiencies and potential dissatisfaction among employees.

Option 2:

ABHI offers a streamlined payroll processing solution through a dedicated portal. ABHI’s partnership with 1 Link allows the firm to run the payroll into different bank accounts in just one click. This eliminates delays, reduces administrative burden, enhances convenience for employees, and centralizes payroll management of the company.

Case 3

A service company relies on extended credit duration from its clients, which results in cash flow constraints. This financial hurdle impacts the company’s ability to fulfill its obligation of timely salary disbursements to employees.

Option 1:

One solution for the service company is to negotiate revised credit terms with its clients. By renegotiating credit duration, the company can reduce the cash flow crunch and ensure sufficient liquidity to meet its payroll obligations. However, this approach may require time and effort, and there’s no guarantee of immediate resolution.

Option 2:

The company could partner with ABHI to leverage its Payroll Financing solution and disburse the salaries to its employees on time, irrespective of the extended credit duration from its clients. This approach not only safeguards employee satisfaction but also boosts retention rates and maintains operational efficiency.

Why it's important to financially

empower employees

conducted a study on Earned Wage Access

conducted a study on Earned Wage Access

Find out how it can elevate employee happiness & productivity

employees face unexpected expenses that can’t be paid through their monthly salary*

of employers believe that employees’ morale and well-being at work is affected when they can’t access funds in an emergency*

71% of the working individuals feel positive about the companies who offer EWA as an added benefit.

Here

to Help

Some Frequently Asked

Questions

Payroll Financing assists your business in navigating cash flow constraints which usually result in delayed salaries. ABHI steps in with its financing solution bridging the gap between inflows and outflows. This not only ensures timely salary payments to employees so their morale is maintained but also empowers businesses for greater financial control.

Payroll Processing solves the problem for companies with employees having accounts in different banks. With AbhiPayroll, an organization can disburse the salary to any bank account or wallet in Pakistan through a dedicated Abhi Portal. This saves both organizations and employees the time and hassle of going through the process of opening a new bank account every time a new joining takes place. Your payroll, your control.

You need to contact our Sales Department and submit the required documents for verification purposes, the Risk Team will take 5-6 days for verification, and if all works well the company gets onboarded. The Customer Success team will give the Portal Demo to the company.

On the day of running your Payroll you have to upload your payroll sheet (in EXCEL format) on our portal and click on “Run Payroll”. In a single the salaries get credited to your employee’s bank account within 5-7 minutes.

Yes, we have stringent security measures in place to protect your data. All data is encrypted, and we regularly conduct security audits to ensure your information remains secure.