Earned Wage Access

Employees are able to access their earned but unpaid salary anytime, anywhere via the app or SMS. They can withdraw their salary, pay their bills and send money to family or friends whenever they want. With ABHI, employees can work without financial stress and employers can enjoy higher productivity.

Earned Wage Access

Earned wage access allows employees to access their earned income 24/7 through ABHI’s mobile app or via SMS. The balance is shown on ABHI’s mobile app, which increases every day, with the maximum amount being reached on the last day of the month. Users are charged a fixed fee on every transaction and the transacted amount gets deducted automatically and the remaining salary gets credited into the user’s account on payday.

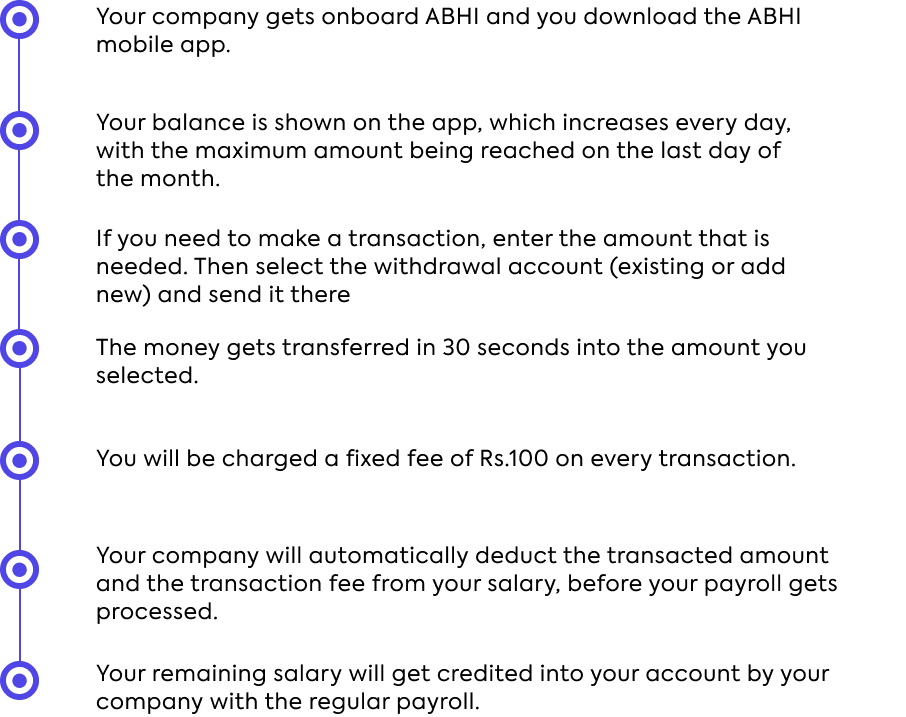

How It Works

Step-by-step process of the user’s journey

-

Your company gets onboard ABHI and you download the ABHI

mobile app. -

Your balance is shown on the app, which increases every day,

with the maximum amount being reached on the last day of

the month. -

If you need to make a transaction, enter the amount that is

needed. Then select the withdrawal account (existing or add

new) and send it there -

The money gets transferred in 30 seconds into the amount you

selected. - You will be charged a service fee on every transaction.

-

Your company will automatically deduct the transacted amount

and the transaction fee from your salary, before your payroll gets

processed. -

Your remaining salary will get credited into your account by your

company with the regular payroll.

Access your Salary in 30 Seconds

Step 1

EMIRATES ID

Step 2

EARNED BALANCE

Step 3

REQUIRED AMOUNT

Step 4

30 SECONDS

Why it's important to financially empower employees

population earns less

than or equal to

PKR 76,900*

unexpected expenses

that can’t be paid

through their monthly

salary*

interest in using the

Earned Wage Access

service*

and well-being is affected

when they can’t access

funds in an emergency*

*In Research report conducted by EY on ‘Earned Wage Access Market in Pakistan 2022’

Use Cases

When and where can this be used?

Here To Help

Your questions, answered

Can I use ABHI if my company is not onboarded?

Just speak to the HR department at your organization and make sure you are added to the system. You should have no problem signing in!

How do I get my company onboard?

You can ask your HR about the cool benefit you’ve found and make them get in touch with us via our contact us page, we will reach out to them and make sure you and your colleagues get the EWA facility

How does the repayment work?

The owed amount is paid to ABHI by your employer along with the services fee and your remaining salary is credited to you in the next payroll cycle.How much salary can I access using ABHI?

Upto 50% of your earned salary.What is the subscription or signup fee?

There is no sign up or subscription fee for you or your company, you only pay when you transact.

How much does ABHI charge?

9 AED for transactions up to 500 AED, and 19 AED for transactions above 500 AED.Still Got Questions?

Contact our friendly helpline, or visit the FAQ page to find answers to your questions/queries

Hamza Zafar

Amazing Service, thank you to my employer for bringing this to us and allowing us to access salary on demand!

Tehreem

No waits no worries, I got my pay fast and easy with the abhi karo app! Good for people who just started with their nokri

Great app also lets you take money from SMS, automatically connects my number and give me money, love you abhi!

Amir Iqbal

Day or night, now I get money from my salary whenever I want to. Thank you abhi, Keep it up!

Javeria

Check Out What Our Users

Have To Say About Us

Hamza Zafar

Amazing Service, thank you to my employer for bringing this to us and allowing us to access salary on demand!

Tehreem

No waits no worries, I got my pay fast and easy with the abhi karo app! Good for people who just started with their nokri

Great app also lets you take money from SMS, automatically connects my number and give me money, love you abhi!

Amir Iqbal

Day or night, now I get money from my salary whenever I want to. Thank you abhi, Keep it up!

Javeria

Just speak to the HR department at your organization and make sure you are added to the system. You should have no problem signing in!

You can ask your HR about the cool benefit you’ve found and make them get in touch with us via our contact us page, we will reach out to them and make sure you and your colleagues get the EWA facility

The owed amount is paid to ABHI by your employer along with the Rs.100 service fee and your remaining salary is credited to you in the next payroll cycle

Upto 50% of your earned salary.

There is no sign up or subscription fee for you or your company, you only pay when you transact.

Rs. 100 per transaction, regardless of how big or small it is.

Still Got Questions?

Contact our friendly helpline, or visit the FAQ page to find answer your queries

Hamza Zafar

Amazing Service, thank you to my employer for bringing this to us and allowing us to access salary on demand!

Check Out What Our Users

Have To Say About Us

Hamza Zafar

Amazing Service, thank you to my employer for bringing this to us and allowing us to access salary on demand!

Tehreem

No waits no worries, I got my pay fast and easy with the abhi karo app! Good for people who just started with their nokri

Hamza Zafar

Amazing Service, thank you to my employer for bringing this to us and allowing us to access salary on demand!

Tehreem

No waits no worries, I got my pay fast and easy with the abhi karo app! Good for people who just started with their nokri

Report

Report