Invoice Factoring

How It Works

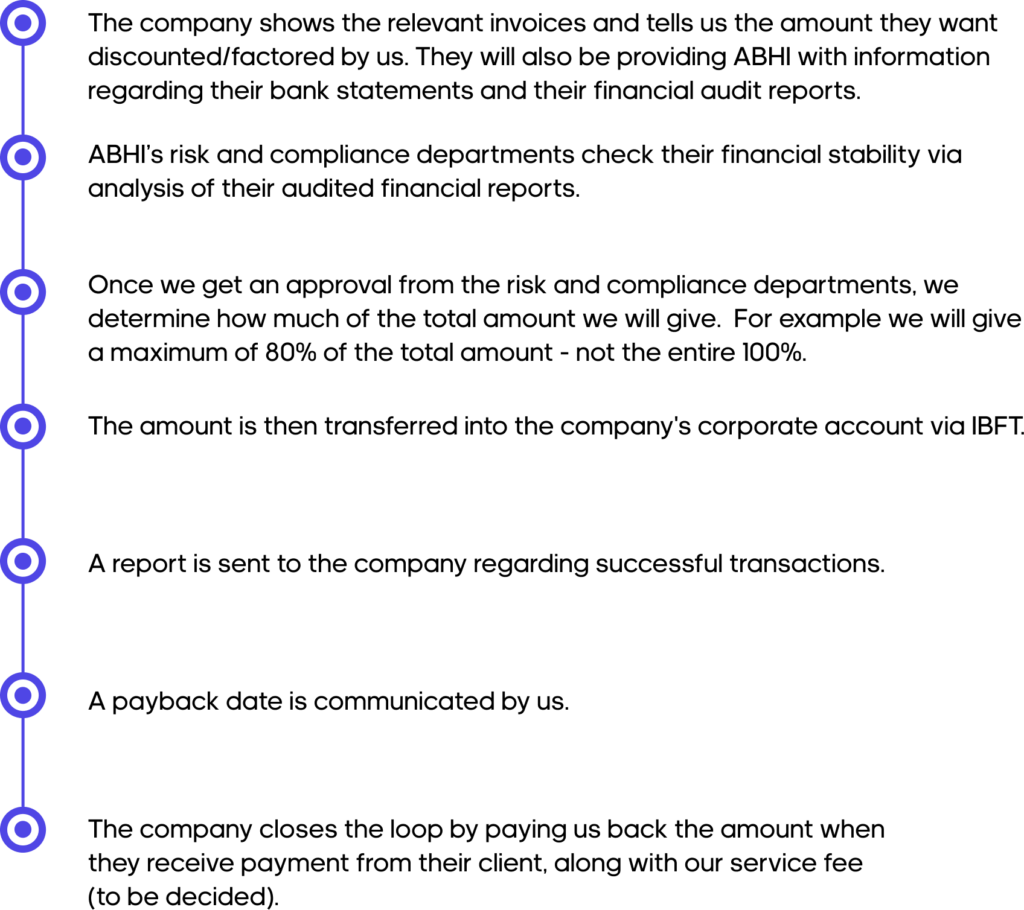

Step-by-step process of the user’s journey

Use Cases

When and where can this be used?

Here To Help

Your questions, answered

Invoice factoring is a financial service of paying a company’s unpaid invoices to keep their operations running smoothly and avoid delays in payment. For example, if you owe money to a vendor and don’t have the cash to pay immediately, ABHI will pay for you and you will later pay back ABHI. To summarize, invoice factoring is basically a short term loan against your receivables.

There is no limit on finance against invoices as it actually depends on the value of the invoice raised. The limit to which ABHI will facilitate the invoice would be set against the financial information of the company. ABHI will provide up to 80% financing against the invoices submitted.

ABHI does short term financing against invoices, the tenure can range from 5 to a maximum of 60 days.

Invoice factoring enables seamless running of operations, as it allows you to avail credit up to a certain percentage of your unpaid invoice’s total value.

Yes, we give short-term loans against invoices only.

Yes! ABHI holds a Non-Banking Financial Company (NBFC) License by the State Bank of Pakistan that allows us to lend money to companies

What is invoice factoring?

Invoice factoring is a financial service of paying a company’s unpaid invoices to keep their operations running smoothly and avoid delays in payment. For example, if you owe money to a vendor and don’t have the cash to pay immediately, ABHI will pay for you and you will later pay back ABHI. To summarize, invoice factoring is basically a short term loan against your receivables.

What is the tenure of this loan?

ABHI does short term financing against invoices, the tenure can range from 5 to a maximum of 60 days.

What is the eligibility criteria?

Any business that supplies goods/services to large blue-chip companies can avail this service. Eligibility and amount of factoring is decided by the creditworthiness of the business and their past financial history. So the companies interested in this service have to be willing to share their financial information and other related documents.

How will it benefit my company?

Invoice factoring enables seamless running of operations, as it allows you to avail credit up to a certain percentage of your unpaid invoice’s total value.

What is the maximum limit for loans?

There is no limit on finance against invoices as it actually depends on the value of the invoice raised. The limit to which ABHI will facilitate the invoice would be set against the financial information of the company. ABHI will provide up to 80% financing against the invoices submitted.

Is it collateral free?

We offer collateral-free lending, however, in certain cases where our risk acceptance criteria does not allow collateral-free lending with clients we enable the provision of collateral from the customer to proceed further.

Are we licensed?

Yes! ABHI holds a Non-Banking Financial Company (NBFC) License issued by the SECP, allowing us to lend money to companies.